Pradhan Mantri Awas Yojana Credit Linked Subsidy Scheme in Delhi NCR

You are at most wonderful moment of your life to buy a happy home for your loved family. Thousands of people like you are taking benefit of low prices in real estate in Delhi NCR. You too can use this opportunity to make intelligent move and buy your dream house at amazing low price. To add incentive for buying your home is PMAY CLSS. It comes with tax benefits on repayment of home loan EMI.

If you are buying first house and your household income is below 18 Lakhs rupees yearly, You can take benefit under this scheme. Buying a house for your family through PMAY CLSS gets you huge difference for period of you home loan repayment. For home buyers like you, this is “Must know” real money saving fact. Go through complete facts and details. Find answer of all your question for “what and how” about PMAY CLSS in Delhi NCR. Discover incredible benefits this webpage has to reveal.

In this scheme you gets fascinating and magnetizing subsidy credit direct in your loan account. Plus you get tax benefit under section 80C and 24 up to 4L every year

Submit your details right now to save thousands every month in you home loan EMI. You gets express fast excellent service and free consultation on home loan. Get loan from leading names in home loan industry. To make these substantial savings, your immediate response is required. Get trouble free home loan at unbeatable rate of interest in Delhi NCR submit your details immediately

Our fast service, free consultation and high speed home loan disbursal are good reason to send your name right now. It takes just few seconds, it’s that easy. You risk nothing when you send your details to us. Don’t miss out send your name quickly to unlock amazing home loan offers you won’t get anywhere else.

Joy Loan for PMAY CLSS in Delhi NCR

Trust me, you don’t deserve so much trouble to live your dream. For your home loan in Delhi NCR, you are about to discover easiest way to get PMAY CLSS. When you apply home loan through us, you get benefit of our experience and knowledge of local area.

All major housing finance companies are listed with CNA to channelize PMAY CLSS. We deals with all major housing finances company. For your loan, we do comprehensive study of your profile and property you are buying. We can get you home loan on challenging property and income from leading housing finance companies.

With us you can get home loan without income proof or on basis on liquid income assessment. In all these income and property type we gets you low interest rate from most economical institution. Low home loan rate of interest Along with PMAY CLSS makes your home loan tremendously economical.

Following are few of benefits, to apply home loan through us

• Coordination from all leading banks and financial institutions

• You sit back and relax with our door step service

• Home loan without income proof / Liquid income assessment

• Home loan on without map, Lal dora, unauthorized colony (with sale deed)

When you choose us you gets a dedicated & professional resource for your home loan. A dedicated qualified experienced manager; specially assigned to you who will do complete analysis of your requirement. Our Managers has high experience in helping people like you to make entire process simplified, effortless, error proof.

As we deals with all major banks, We picks fascinating offers that gives you huge saving in your home loan EMI. Add to this, PMAY CLSS reduces your repayment tenure drastically. We do everything to maximize your saving and reduce your initial cost.

Simply fill your details. We will do all this for you. We will provide “Door Step Service” from comfort of your home or office”. So you can enjoy your time with family

If you want to take competitive edge of an experienced and professional partner, your immediate response is require. Submit your details immediately.

Send your details to get amazing benefits under Pradhan Mantri Awas Yojana

Get Me PMAY Benefit

PMAY HFA(U) Scheme Details

PMAY HFA(U) Scheme Details

PMAY HFA(U) was started with vision of every EWS, LIG and MIG family to have all weather (pucca) house. It is for benefit of first time home buyer family which does not have a “pucca” house. A beneficiary family in this scheme means husband, wife and unmarried children. These houses shall have all basic amenities like water connection, toilet and electricity.

I have provided in depth, extremely informative, detailed analysis and complete facts. You can learn comprehensive, insightful description about benefits and process. With PMAY CLSS home loan effective rate of interest can be as low as 1.85% yearly. Availability of many affordable houses along with this scheme makes buying home for your family more appealing.

You gets fascinating effective rate of interest on your home loan. Good thing is you gets your subsidy up to 2.67 Lakhs credited direct in your loan account. It can effectively reduce your home loan repayment tenure to approximately 50%

No doubt this scheme is boon for first time home buyers. But entire process is complicated and takes 5-6 months to get your subsidy with complete follow-up.

Details of Subsidy Benefits

Details of PMAY CLSS Subsidy Benefits

PMAY CLSS will be provided on home loans taken by eligible families (EWS / LIG / MIG1 / MIG2) for acquisition, construction or expansion of house. Following are benefits ofscheme

• Low effective rate of interest on home loan

• Subsidy up to 6.5% on interest

• One time subsidy of 20 years credited in your loan account.

Eligibility for PMAY – CLSS

Eligibility for PMAY – CLSS

To be eligible under PMAY CLSS you should be first time home buyer family. You shall not have a pucca house anywhere in India.

If you fulfills condition of income and property size (as explained below), you are eligible to get subsidy. For subsidy, you shall purchase property in name of female head your family. You can also be purchase in the joint name of the male head. Only if there is no adult female member your family, you can purchase house in male member name.

Apart from amount of subsidy based on family income, there is additional guidance for size property as below

• EWS up to 30 Square meters

• LIG up to 60 Square meters

• MIG1 – up to 90 square meters

• MIG2 – up to 110 square meters

Your family can build a house of larger area, but amount for subsidy would be limited to cost of approved size.

Calculation of Interest and Home Loan EMI reduction under PMAY CLSS

Calculation of Interest and Home Loan EMI

Click here to download HUDCO– PMAY CLSS-Subsidy Calculator in excel form.

This is latest calculator currently being used by them (Download). In this calculator you can do exact calculation for benefit of subsidy you can get. For diffrent income group, different pages are made e.g. EWS, LIG, MIG1 and MIG 2 . For calculation, you have to make entry on your relevant page. These are few simple entries like, loan amount, loan tenure and rate of interest. Option of disbursement in installments is also given in this PMAY CLSS calculator

Depending on your income group and size of house you buy, you will be eligible up to 6.5% interest subsidy under

Following are income slab and interest subsidy slab

• EWS (Income Up to 3 Lakhs): 6.5% subsidy on up to 6 Lakhs loan

• LIG (Income between 3 Lakhs – 6 Lakhs): 6.5% subsidy on up to 6 Lakhs loan

• MIG1- (Income between 6 Lakhs – 12 Lakhs): 4% subsidy on up to 9 Lakhs loan

• MIG2- (Income between 12 Lakhs – 18 Lakhs): 3% subsidy on up to 12 Lakhs loan

The interest subsidy is calculated at 9% NPV over a maximum loan tenure of 20 years or the actual tenure, whichever is lesser. Home loan above given above income wise slab are non-subsidized

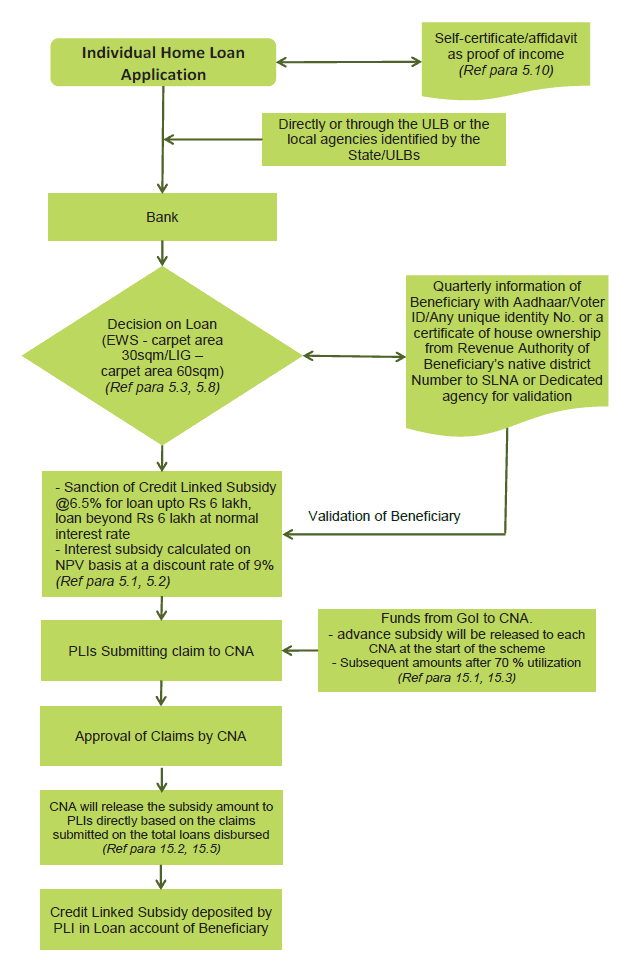

Snapshot of process

Snapshot of process

To get PMAY CLSS from Government of India, your application is processed by CNA. There are only 2 of them HUDCO and NHB. If you are entitled, you can apply for subsidy through bank / housing finance company.

Then CNAs, on behalf of bank / housing finance company, sends your application to your States/UTs. They will confirm, that you have not taken benefit under other three verticals of the Scheme. Other verticals of scheme are Slum redevelopment / Affordable housing through builder / Subsidy for beneficiary led individual house construction or enhancement. State /UT of your native district will confirm from local revenue record, that no house is already owned by your family as per their records.

For a home buyer like you, applying for PMAY CLSS and getting subsidy credit is really challenging. At the first place it is difficult to know, how to apply. Second it is hard to spare enough time.

How PMAY CLSS is processed?

How PMAY CLSS is processed?

I have listed following abbreviation which are relevant to this page apart from chart as below

PLI: Primary Lending Institutions

CNA: Central Nodal Agencies

EWS: Economically Weaker Section

LIG: Low Income Group

MIG: Medium Income Group

CLSS: Credit Linked Subsidy Scheme

NHB: National Housing Bank

HUDCO: Housing and Urban Development Corporation

PMAY: Pradhan Mantri Awas Yojana

PMAY– HFA(U): Pradhan Mantri Awas Yojana – Hous¬ing for All (Urban)

How to apply for PMAY CLSS

How to apply for PMAY CLSS

You need following documents to apply PMAY CLSS

- Self-certificate / affidavit for income

- Format A and B of Annexure 4 Para 8.3 of guidelines

- Aadhaar/Voter ID Card / Any other unique identification Number

To get subsidy benefit, you can apply with Scheduled Commercial Banks or Housing Finance Companies. They will forward your application to CNA. HUDCO and National Housing Bank (NHB) are only Central Nodal Agencies (CNAs) to credit subsidy to the lending institutions.

State/UTs/ULBs/ PLIs links beneficiary identification to Aadhaar, Voter card or any other unique identification. Certificate of house ownership is also checked from Revenue Authority of Beneficiary’s native district to avoid duplication. Preference under the Scheme, is given applicant from Manual Scavengers, Women (with overriding preference to widows), persons belonging to Scheduled Castes/Scheduled Tribes/Other Backward Classes, Minorities, Persons with disabilities and Transgender. State Level Nodal Agency (SLNA) facilitates the identified eligible beneficiaries in getting approvals and documents, etc. to avail of credit linked subsidy.

CNAs, on behalf of PLIs sends list of beneficiaries under CLSS to concerned States/UTs. Concerned States / UTs monitors this list. They decides beneficiaries while checking other three verticals of the PMAY (Slum redevelopment / Affordable housing through builder / Subsidy for beneficiary led individual house construction or enhancement). It is to insure, no beneficiary can apply more than one benefit under the Mission.

To assist you to apply, I have listed official contact details that can help

- PMAY HFA(U) Official Document: Click to download (Older Version)

PMAY Website: http://pmaymis.gov.in

NHB Call Center: 1800-11-3377 and 1800-11-3388

HUDCO Call Center: 1800-11-6163

Act Now to make your home loan exceptionally affordable

How to get PMAY CLSS

There is huge process involved with PMAY CLSS, but buying your dream house doesn’t have to be difficult. To make it super simple, you can get in touch with us for your home loan. We deals with major companies which can offer you home loan with this scheme.

It removes pain factor from your home loan and time spent for subsidy. You can simply rely on us. Because, before we finalize any home loan option for you, we do complete analysis of your profile and property. Based on comprehensive and extensive study we offer you most economical and best home loan option that offers.

When you apply your home loan through us, you gets your CLSS automatically credited direct to your loan account. You gets more amazing benefits, when you get your home loan through us. You get solution of home loan on vast property types as we deals with leading financial institutions for your home loan. Few property and income type we deals are mentioned below

• Home Loan on without map property

• Home loan in Lal Dora,

• Home loan in unapproved colony (With sale deed only)

• Home loan on double / Triple / Multiple units on same floor

• Plot purchase loan (Approved / Unapproved / Lal Dora)

• Construction loan (Approved / Unapproved / Lal Dora)

• Expansion / extension / renovation loan

• Liquid Income assessment (Low ITR)

• No income proof

Most bank and financial institutions have kept many areas in negative list for home loan. With us you can get home loan on many challenging property or income types for small one time advisory fee. This onetime fee is fraction of price. Get you home loan effortlessly ensuring most profitable deals available for you along with PMAY CLSS.

We really care for making your dream come true. With us you gets your home loan effortlessly with our door step service. Our professional, committed, reliable and promising filed staff serves you at your desired place for filling form and compete documentation. Our skilled and specialized staff gives you comprehensive support to make your home loan a pleasant experience.

You gets express fast sanction and swiftest, speedy disbursal of home loan. You get home loan from mainstream financial institutions giving you maximum saving. You save thousands ever month with a home loan from us. This massive saving comes direct to you with low rate of interest.

Take advantage of affordable rate of interest by choosing us. Many financial institution charge you high rate of interest and processing fee. Take action now to get unique offer for your home loan. Cut cost of your EMI with our competitive edge. Stop wasting time to get competitive edge of our knowledge and services. Submit your name right now.

Be assured of outstanding home loan offer with deals better than our competitors. Don’t let our competitors misguide you. We give you complete facts, so you see the saving. With us you gets our home loan at fraction of cost you will spend anywhere else. Our time saving and money saving offer is exclusively for you. You gets our distinguished service at small onetime fee that you pay only after sanction of loan.

We can easily get you home from mainstream banks / financial institutions with PMAY CLSS. You can save your time with our amazing door step service. You can get expert advice and remarkable savings effortlessly. All you need to do is \submit your details with us.

We will get you amazing reduced rates that will save you money. So if you want to save thousands every month, send your name for no obligation quotes and expert advice. Our simplified process save you lot of time and money as well. Our first class exceptional service is like no other.

Enjoy fast sanction and disbursal of your home loan with no-nonsense service. We have helped hundreds of customers like you to get cost effective home loan better than our competitors can offer. You can get comprehensive support and winning offer that will give you substantial saving. Why pay extra when you can get all bargains with banks by just submitting your details.

Don’t delay, get competitive edge of expert home loan provider in Delhi NCR. Others will cost you twice as much. Now is time, Act right now!!.

Send Your Details right now to get Amazing benefits under Pradhan Mantri Awas Yojana

Now is Time. Send it immediately

Unable to fill quarry form? Submit your details here