Get Money for Your Child’s Higher Education For Free

A substantial amount of your income is going to bank to repay your home loan. This can be as high as 50% of your total income, or even more. You think there is no money to invest for any purpose however important it may be. What if I tell you, just keeping your home loan tuned at lowest rate of interest can get you funds for your Child’s higher education. You might laugh away. But yes it’s true. Keep reading for your life changing details below

How Much Can I Save with Home Loan Balance Transfer?

You made a wise decision when you choose to take home loan from your existing bank. Because you did extensive analysis of all the loan option available at that point of time. But home loan market is dynamic. As best ROI are offered on floating rates it gives bankers freedom to change it as & when they wish to.

Your bank which was most competitive at time has also increased your home loan rate of interest. But in order to stay competitive they continues to offer lower rates to new customers. Now possibility is your might be paying 1.25% or more then best deal offered to new customers by banks today. Chances are more so if your had taken your home loan more than 2 years ago.

So do you feel, your home loan EMI is not letting you enjoy your life? Think of home loan Balance Transfer. Check below to see how much you can save with home loan balance transfer. See what 1.25% rate difference means in terms of money you will save on your EMI payment.

[supsystic-tables id=’8′]

Example of 50 lakhs loan running @ 10.75%. Higher Rate of Interest means more saving.

Click here to download Excel Home Loan EMI Calculator to see your savings in EMI.

[mc4wp_form id=”1322″]

Saving Calculation on Home Loan Balance Transfer

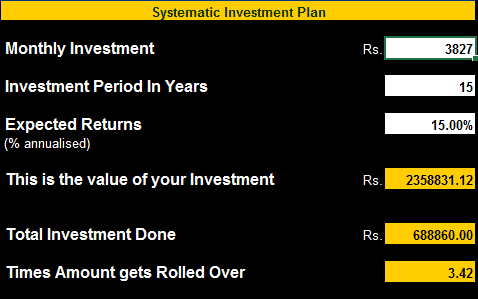

As you can see, you are saving 3827/- monthly. This amount looks small but if you invest this savings, you can pay your child’s higher education without taking expensive loans later. There are many investment instruments, where investing for 10 – 15 years can get you returns between 15% – 18% on yearly compounded basis.

You can invest saved amount in SIP through ECS. Look below at saving calculation on home loan balance transfer (snapshot below). See, corpus collected after 15 years.

Click here to download investment calculator to see, how much you will make from your savings in home loan EMI

Is It Right Time to Do Home Loan Balance Transfer?

After RBI guidelines of no foreclosure charges on Home Loan Balance Transfer are applicable. As banks are not taking foreclosure charges, there was never a better time to transfer you home loan from high Rate of interest lender to most competitive rate of interest in year 2016. Even Home Loan balance transfer Processing Fee is nominal. You can transfer home loan for built up property, under construction property or loan for plot.

When Home Loan Balance Transfer is not Advised?

If your home loan remaining tenure is less or you have smaller outstanding balance in your home loan, you may not save much due to initial cost involved with home loan balance transfer. On transferring home loan, if rate of interest difference is 0.5% of less, then it may not be good idea unless outstanding loan amount is very high.

you feel to say anything on any of above points with your personal experience. Feel free to write it here. Your comment can help others. THEY WILL THANK YOU FOR THIS!!

Sir, am Mrs Qurashi my Flat Dox with Repco finance can I take take over from them to your bank

Hi Rabiya!

First, we are not bank, but loan coordinator. Second, For retail loans we are serving only Delhi NCR. Repco deals in altogather diffrent locations.

So no.

Yet you can contact your local loan coordinator to transfer your home loan for lower rate